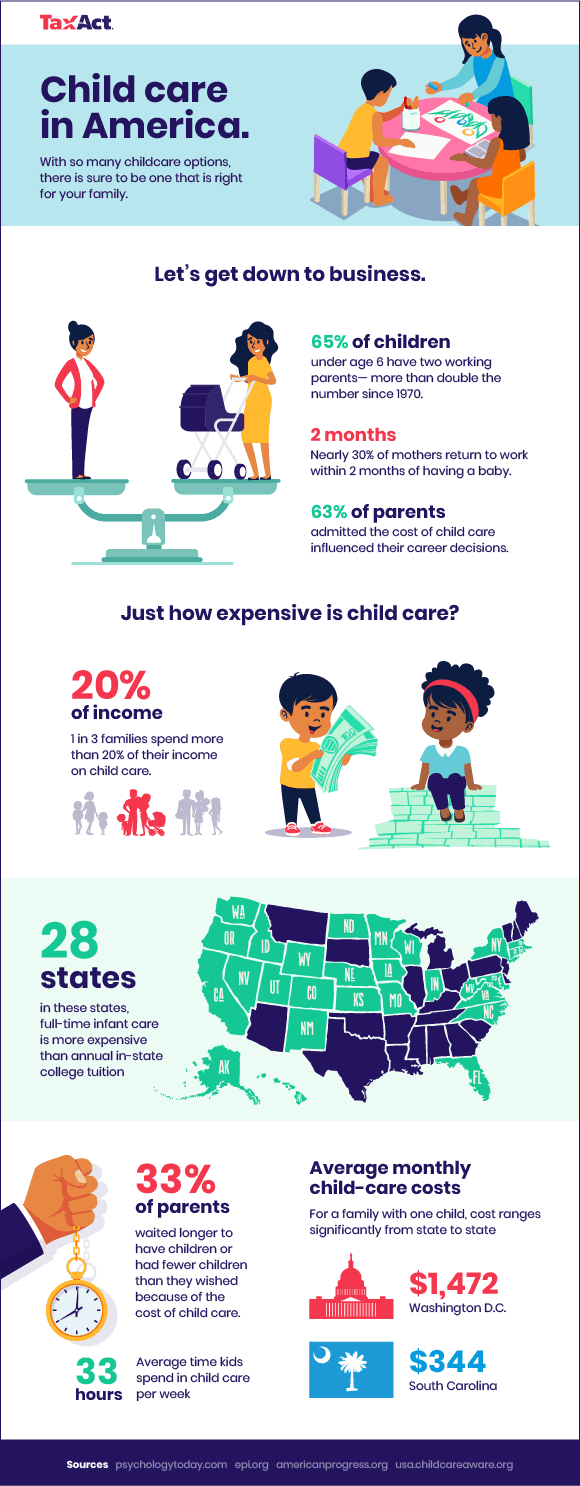

Some parents break out in hives at the thought of leaving their new child in someone else’s care. Others are excited to interview child-care professionals and get back to the office. Wherever you fall on the spectrum, finding good child care can be stressful and expensive. In some states, infant care costs more than in-state tuition at a four-year university.

If you’re feeling some mixture of guilt, helplessness, or exhaustion as you navigate your child-care options, you’re not alone. But we’re here to help. Keep reading to discover the choices available for child care and get tips for finding high quality, affordable care.

Quality Child Care Matters

The early years of children’s lives lay the foundation for future cognitive functioning, behavior, and socialization skills. The human brain develops the majority of its neurons and is most receptive to learning before the age of five. Children who attend a high-quality preschool have measurable benefits even 35 years later, according to a study.

Unfortunately, not all child care is first-rate. In one investigation of U.S. child-care operations, only 10 percent were rated as high quality, meaning they offered a positive caretaking experience including reading, music, and teaching. The majority were rated as fair. But you can increase your odds of finding excellent care by starting your search early and researching different alternatives.

Know Your Options

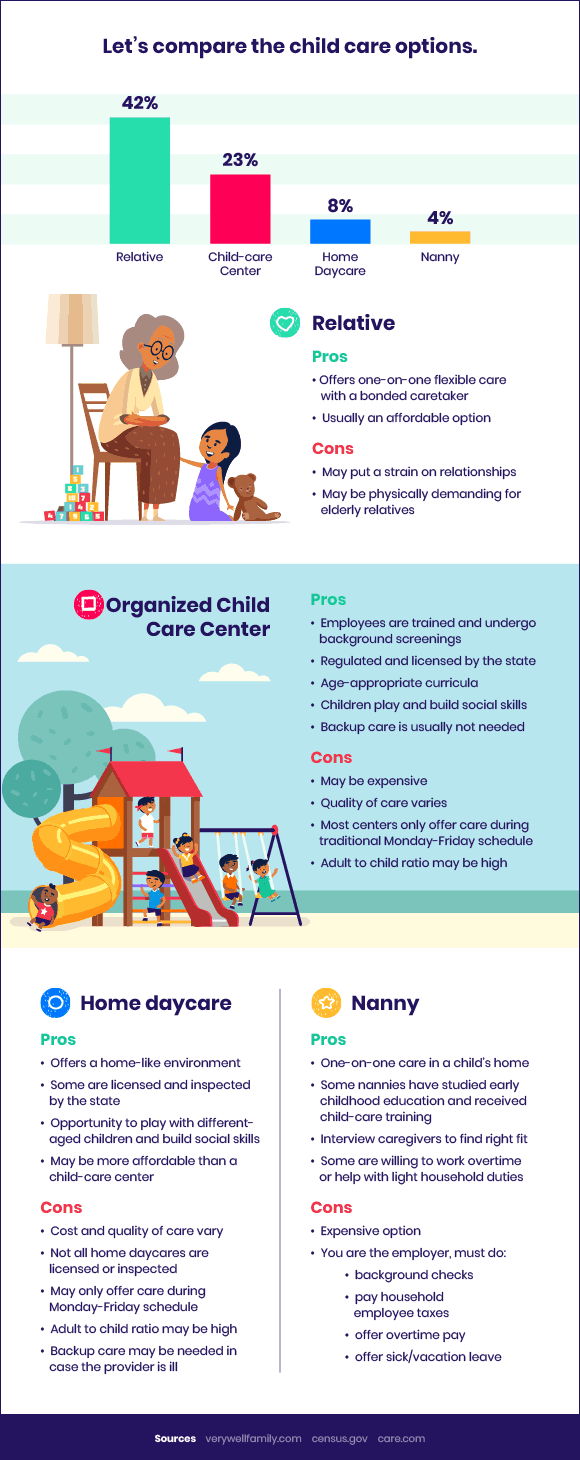

Most children in the U.S. are cared for by one of these types of providers:

Forty-two percent of American families rely on relatives to help care for their kids. The arrangement has many perks. Children get one-on-one care in a familiar environment and usually already have a tight bond with their caretaker. Plus, relative care is usually more flexible and affordable than organized care. Family members can negotiate a payment system that works for all parties. Some relatives offer care for free. Others trade care for room and board or exchange money for services.

On the downside, negotiating child-care arrangements and managing the day-to-day routine of caring for children can put a strain on extended families. Taking care of young children can also be physically and mentally demanding for grandparents, who make up the largest percentage of relative caretakers.

- Professional In-Home Care Providers

Hiring a nanny or au pair to watch your children offers many of the same advantages as care by a relative, including flexible hours and one-on-one attention. Plus, your child has the ease and security of staying at home.

But employing a nanny is not simple, and it’s usually the most expensive option. In the U.S., nannies make about $19 per hour on average. The parents become an employer, which means they need to:

- Conduct interviews

- Do background checks

- Check references

- Draw up a detailed contract explaining expectations and policies

- Pay household employer taxes (if the nanny makes more than $2,100 a year)

- Provide overtime pay and sick and vacation leave

- Arrange for backup care in case of illness

Hiring a nanny may be worth the labor and expense, depending on your situation. In one survey, 54 percent of nannies had a degree in early childhood education or another child-related subject area. The majority of nannies are trained in CPR and first aid. Some are willing to work flexible hours, and some provide light housework in addition to child care.

Organized Child-Care Facility

If a relative or professional in-home care provider isn’t right for you, it may be time to investigate child-care facilities. They’re licensed by the state to ensure safety, and some are accredited by the National Association for the Education of Young Children (NAEYC) to ensure quality. Child-care facilities offer children the opportunity to socialize, usually with a group of same-aged children. Many facilities offer meals, educational curricula, field trips, and other perks.

On the downside, facilities vary in quality, and full-time care at a child-care facility can be expensive. Not surprisingly, children cared for in group settings also tend to get sick more often than children cared for at home.

Home Daycares

A home daycare may be a more affordable and homier option for group child care. At home daycares, children usually socialize with babies and young kids of all ages rather than being grouped by age. Like child-care facilities, some home daycares offer educational curricula, field trips, meals, and other perks. But be cautious because not all home daycares are licensed by the state, and they vary in quality. It’s important to do your homework.

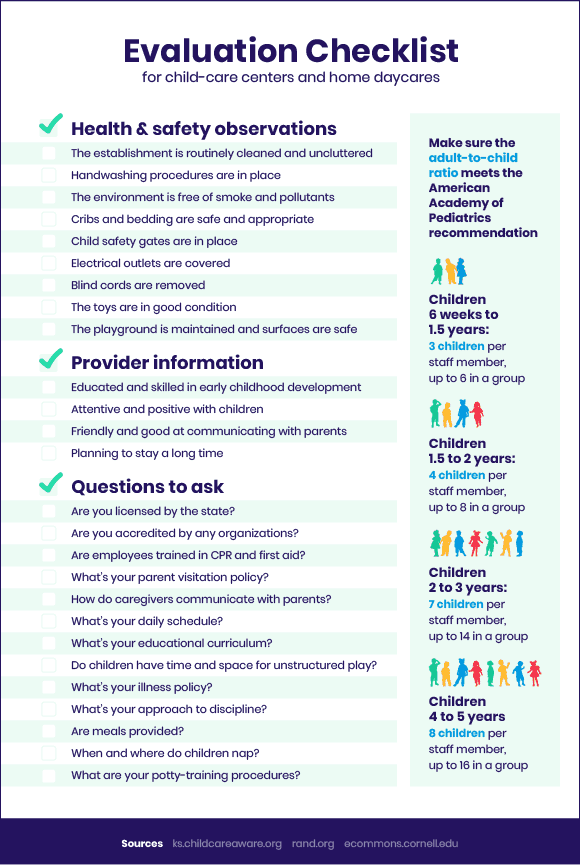

It may feel daunting to find a good child-care facility or home daycare. First, ask your friends for recommendations and read online reviews. Then do tours and conduct interviews. Make sure the daycare is safe and clean. Also, pay attention to how you feel in each space, and note how well the caretakers relate with the children.

Tax Savings for Child Care

Paying for child care can feel like shelling out a second mortgage. But there’s good news: Families paying for care may be able to save on their taxes with one of these options.

- The Child and Dependent Care Tax Credit

Working parents are eligible for a non-refundable federal tax credit of 20 to 35 percent of their child-care expenses up to $3,000 per year for up to two children under the age of 13.

Parents who earn less than $15,000 per year qualify for the 35 percent credit. The credit percentage drops by 1 percent for every additional $2,000 the parent earns until it reaches 20 percent. Earners that make more than $43,000 per year qualify for the 20 percent credit. A low-income earner with two children receiving care could get a credit of up to $2,100, and a higher-income earner with two children receiving care could get a credit of up to $1,200.

Dependent Care Flexible Spending Account (FSA)

Your employer may sponsor this type of account, which enables you to pay for up to $5,000 per household per year of child-care expenses with pre-tax dollars. The Dependent Care FSA is sheltered from federal, state, Social Security, and Medicare taxes. According to one analysis, someone in the 24 percent tax bracket who contributes $5,000 per year to a Dependent Care FSA would save about $1,583 a year on taxes.

You can’t claim both benefits for the same child-care expenses. But if you have two or more children, you can use the Dependent Care FSA to pay your first $5,000 worth of expenses. Then you can claim the Child and Dependent Care Tax Credit for $1,000 of the remaining expenses.

Conclusion

Parents want the same thing for their children: kind and loving care in a safe and enriching environment. By understanding the pros and cons of different child-care arrangements, you’re on your way to finding high-quality care that’s right for your family.

Share this Image On Your Site